Making Tax Digital (MTD) is a government initiative that sets out a bold vision for the UK to have “one of the most digitally advanced tax administrations in the world”.

The aim of the government’s MTD initiative is to: “…make it easier for individuals and businesses to get their tax right and keep on top of their affairs”. It promises to make tax administration in the UK: “…more effective, more efficient and easier for taxpayers to get their tax right”.

Put simply, MTD involves using compatible software to manage your tax affairs with HMRC.

What is MTD for income tax?

Under the requirements of MTD for income tax, individuals who are subject to income tax on the profits of their trade, profession, vocation or property business will be required to keep their accounting records electronically and file quarterly returns with HMRC including details of their income and expenditure together with any other information that HMRC specifies.

What is the timetable for MTD for income tax?

HMRC have confirmed that MTD for income tax will be introduced from April 2023, for unincorporated businesses and landlords with gross income over £10,000. The rules will also apply to partnerships with business or property income.

The rules will also apply from April 2023 to partnerships with business or property income that only have individuals as partners. All other partnerships (e.g. those that have corporate partners and Limited Liability Partnerships) are not required to join MTD for income tax in April 2023, but will be required to join MTD at a future date (which is to be confirmed).

Trusts, estates and trustees of registered pension schemes will not be required to join MTD for income tax.

Are there any exemptions from MTD for income tax?

Threshold

In order to be within scope, the individual, partnership or trust must have total business or property income above £10,000 per year.

The threshold of £10,000 applies to gross income or turnover, not profit, and it is understood that it applies to the total gross income where the individual or entity has more than one trade or property business. For example, if the individual has £6,000 of rental income and £7,000 of sales from a sole trader or partnership business, they will exceed the £10,000 limit and be in scope.

Exemptions

In line with the exemptions for MTD for VAT, individuals should not have to follow the MTD for income tax rules if any of the following apply:

- It is not reasonably practicable for them to use digital tools to keep their business records or submit quarterly returns due to age, disability, remoteness of location or any other reason (often referred to as ‘digital exclusion’).

- They are subject to an insolvency procedure.

- The business is run entirely by practising members of a religious society or order whose beliefs are incompatible with using electronic communications or keeping electronic records.

What will be the impact of filing quarterly income tax returns?

Tax return filing dates

Individuals who are within the scope of MTD for income tax will be required to file quarterly returns with HMRC that include details of their income and expenditure, together with any other information that HMRC specifies. A final end of period statement will then be submitted after the tax year to complete the individual’s tax affairs.

The first tax year to be affected is 2023-24, which runs from 6 April 2023 to 5 April 2024.

Assuming your accounting period is in line with the tax year, your filing obligations will be as follows:

- The first report will be due in August 2023.

- The second report will be due in November 2023.

- Your self-assessment tax return for 2022-23 (the previous tax year) will be due by 31 January 2024.

- The third report will be due in February 2024.

- The fourth report will be due in May 2024.

- The fifth and final year-end report will be due in January 2025.

Tax payments

Your income tax liability will still need to be paid by 31 January of the following year (as is currently the case). However, you will be allowed to voluntarily pay your taxes as you go, although the detail of this is still being decided.

Eventually, it is possible that you will be required to make four payments per year on account of tax. However, this has not yet been confirmed at this stage.

Penalties

We understand that there will be no late filing penalties for at least a year while the new system beds in. After that, you will suffer penalties if you file your returns late.

How can BW Business Accountants & Advisers help me with the transition to MTD for income tax?

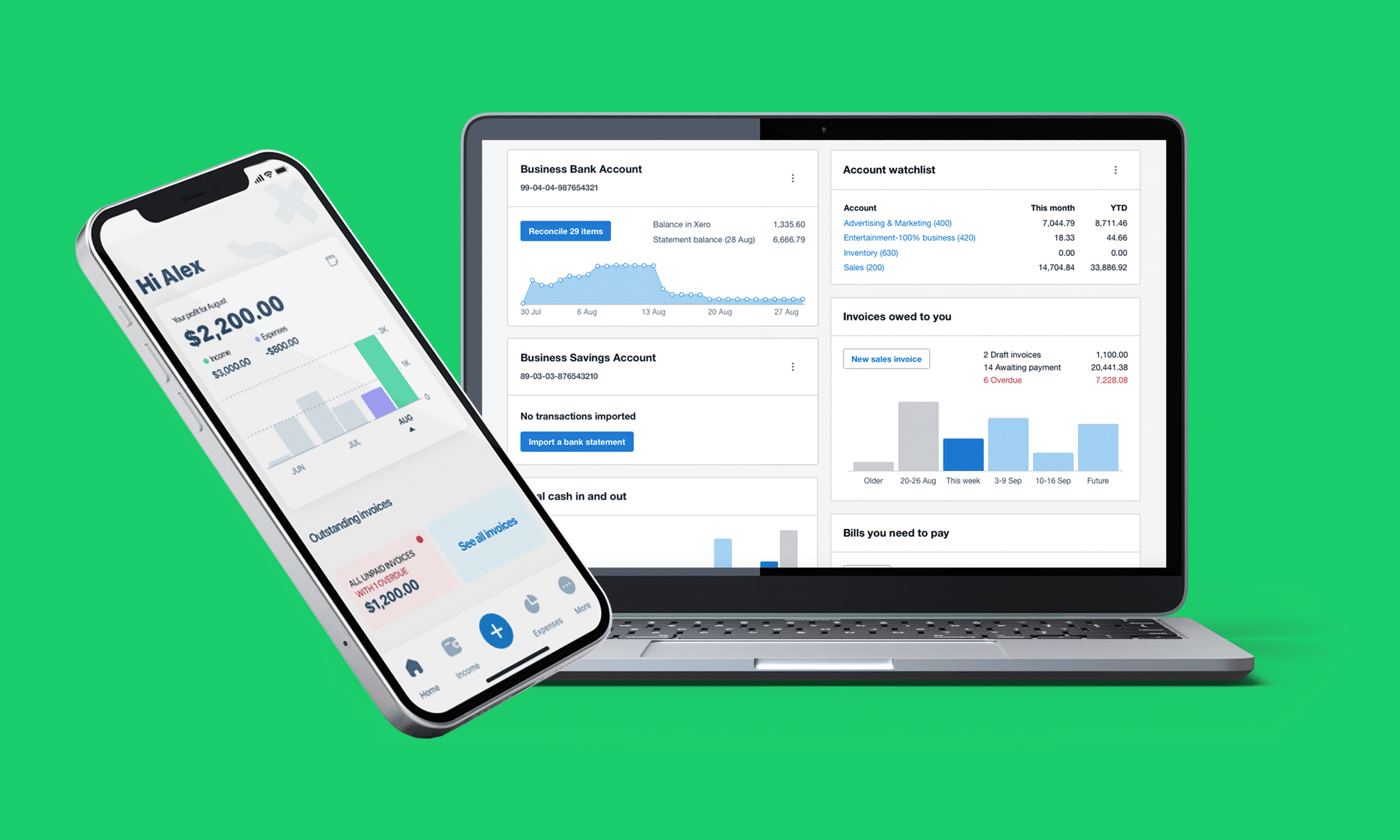

As Xero Bronze Partners, we already have extensive knowledge and experience of using Xero to maintain business’ accounting records. Xero are also currently developing an online solution that allows you to file your self-assessment return with HMRC directly from Xero.

We have already successfully transitioned several businesses to online record keeping using Xero in advance of MTD for income tax being brought in.

We would be delighted to assist you with the transition to online record keeping and provide you and your team with training to optimise your use of Xero’s software.

If you would like to discuss how we could assist you with the MTD transition then let’s talk!